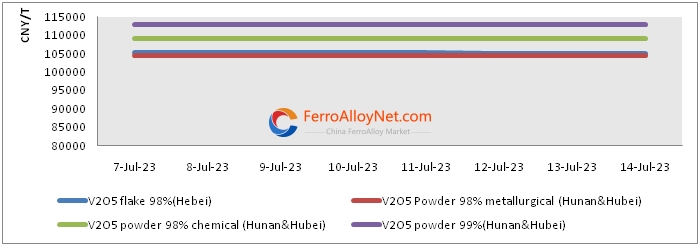

www.ferroalloynet.com: Vanadium market is declining slight with 500-2000 CNY/T this week. The overall demands from steel were weak after the steel bidding for VN alloy finished last week. And though the large V2O5 flake factory increased their long term order prices to 108,000 CNY/T by acceptance with tax and 106,500 CNY/t by cash with tax, the overall deal prices from retail V2O5 flake producers still declined this early week. It is forecast that the overall vanadium market may keep this slow next week.

1. Summary of Vanadium Biddiding in July 2023

|

Company

|

Products |

Price ( CNY/T) |

Quantity ( Ton) |

Basis |

Date |

|

One steel mill in Xinjiang |

FeV50 |

118,000 |

30 |

Acceptance with tax |

3rd July |

|

One steel mill in Fujian |

VN16 |

163,900 |

30 |

Cash with tax |

4th July |

|

Yunnan Chenggang |

VN16 |

163,600 |

30 |

Cash with tax |

4th July |

|

One steel mill in Liaoning |

V77N16 |

168,000 |

75 |

Acceptance with tax |

4th July |

|

One steel mill in Liaoning |

V77N16 |

168,000 |

75 |

Acceptance with tax |

4th July |

|

JISCO Yuzhong Iron & Steel |

V77N16 |

167,500 |

30 |

Acceptance with tax |

4th July |

|

One steel mill in Shandong |

VN16 |

163,800 |

60 |

Cash with tax |

5th July |

|

Anhui Changjiang Steel |

VN16 |

165,000 |

90 |

Acceptance with tax |

6th July |

|

Shougang Tonggang |

VN16 |

164,570 |

15 |

Cash with tax |

6th July |

|

Shaogang Steel |

VN16 |

165,000 |

190 |

Acceptance with tax |

7th July |

|

Shougang Changzhi |

VN 16 |

164,200 |

20 |

Acceptance with tax |

7th July |

|

Zenith Steel Group |

VN16 |

164,000 |

75 |

Acceptance with tax |

7th July |

|

One steel mill in Hunan |

VN16 |

165,000 |

20 |

Acceptance with tax |

7th July |

|

One steel mill in Jiangsu |

FeV50 |

115,100 |

60 |

Acceptance with tax; including bidding service fee |

10th July |

|

Shaogang |

FeV50 |

114,500 |

64 |

Acceptance with tax |

12th July |

|

EGANG |

FeV50 |

114,500 |

20 |

Acceptance with tax |

12th July |

|

Minyuan Iron & Steel |

V77N16 |

159,000 |

20 |

Cash with tax |

13th July |

|

One steel mill in Shandong(Rizhao) |

FeV50 |

117,500 |

30 |

Acceptance with tax |

13th July |

|

One steel mill in Shandong(headquarters) |

FeV50 |

115,500 |

30 |

Cash with tax |

13th July |

|

Wugang Xiangyang |

FeV50 |

115,300 |

10 |

Acceptance with tax |

13th July |

|

One steel mill in Henan |

FeV50 |

112,600 |

10 |

Cash with tax |

13th July |

|

One steel mill in Hebei |

VN16 |

165,300 |

35 |

Acceptance with tax |

13th July |

|

One steel mill in Shandong |

VN16 |

162,000 |

60 |

Cash with tax |

13th July |

|

Kunming Iron & Steel(Anning Base) |

VN16 |

163,500 |

20 |

Cash 60% +6 month bank acceptance 20% +6 month commercial acceptance 20% |

14th July |

|

Shougang Changzhi |

VN16 |

163,450 |

20 |

Acceptance with tax |

14th July |

The chemical grade of vanadium pentoxide powder market is running smoothly. It’s difficult to purchase at low prices for some terminal producers. Overall, the vanadium pentoxide market fluctuated weakly this Friday.

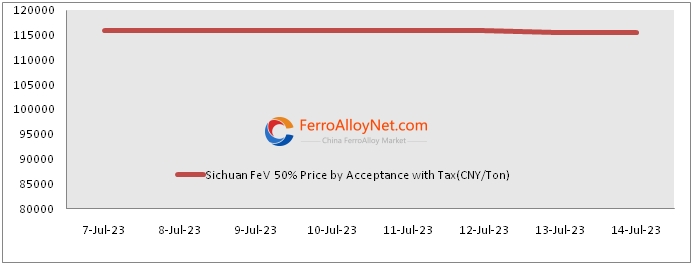

Ferro-Vanadium Market

The ferrovanadium market this week declines by 500 CNY/T to 114,000-117,000 CN/t delivery by acceptance with tax. And the key reason for this price slip is that the dropping price of raw material after large V2O5 flake producers set the prices. And the imported V2O5 flake also appropriately reduces the cost of manufacturers which put the bidding price of ferrovanadium to be difficult to reach the mid-to-high level. Finally, the terminal demand has not improved; the downstream has insufficient confidence in the development of the future market and prefers to sell at lower prices.

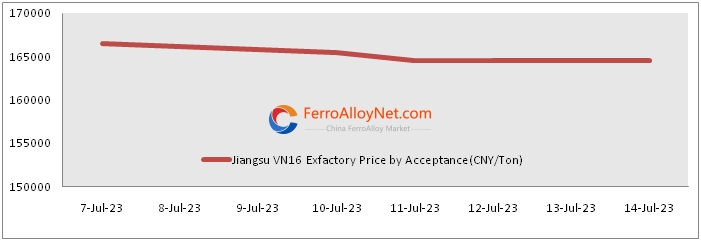

Vanadium Nitrogen Market

This week, the vanadium nitride alloy market drops by 2000 CNY/T to 164,000-165,000 CNY/T by acceptance with tax. As the raw material prices decline though the large V2O5 flake producers increased the long term order prices at 106,500 CNY/T by cash with tax while the real deal prices were still 103,500-106,500 CNY/T by cash with tax. On the other hand, the overall steel bidding for VN alloy had finished and the overall demands were shrinking. Finally, vanadium producers were out of the confidence in the vanadium which puts them sell the goods once the market has some movements to ensure stable production.

3. Vanadium worldwide market review

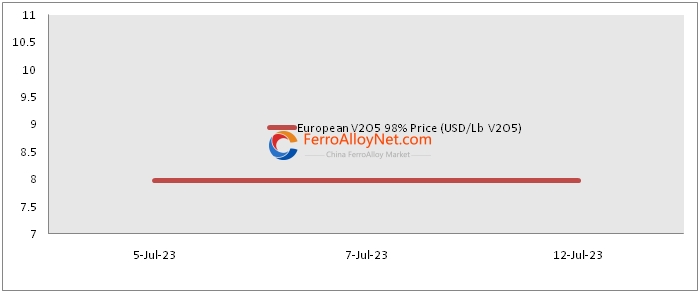

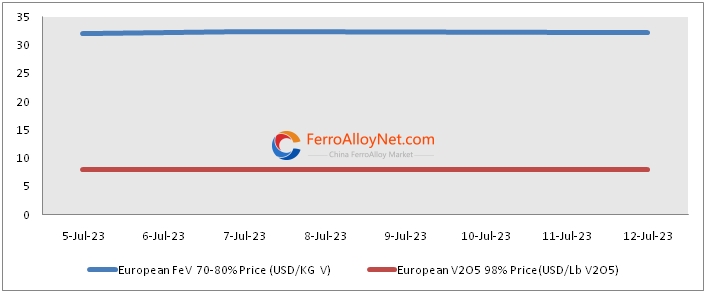

On July 12, European ferrovanadium was 31.5 (up 0.3)-33.06 (down 0.6) USD/Kg V, equivalent to the price of ferrovanadium50 about 112,900-118,800 CNY/Ton; European vanadium pentoxide was 7.5-8.46 USD/Lb, equivalent to vanadium pentoxide98% about 116,300-131,200 CNY/Ton; U.S. ferrovanadium was 16.5-17 USD/Lb V, equivalent to the price of ferrovanadium50 about 130,500-134,600 CNY/Ton.

The recent transactions in Europe continue to fluctuate at a low level, but because the overall price is low and international vanadium manufacturers are facing cost pressures, they are more supportive of prices; however, the market demand is weak, and it is not easy to trade at high prices.

3. Forecast on next week

FerroAlloyNet is expected that the overall vanadium market next week may keep stable with small values downwards. Firstly the overall supply for V2O5 flake remains to be overdue. And then some raw materials factories prefer to wait and see rather than to sell at lower prices. And then traders are waiting for the chance to bottom up once the vanadium prices going down dramatically. Some traders are paying more attention to the changes in the vanadium pentoxide flake market. If the price of vanadium pentoxide flake falls below 105,000 CNY/T by cash again, traders will definitely increase their buying sentiment. Will the vanadium price rebound at a low price that time?

www.ferroalloynet.com