Vanadium weekly review (July 2-6, 2018): Chinese vanadium market skyrockets

Date: Jul 06, 2018

www.ferroalloynet.com: This week, underpinned by continued supply tightness, Chinese vanadium market continues uptrend. Ammonium metavanadate market is impacted greatly by environmental inspections, posing production in decrease. Vanadium pentoxide price increase reaches almost 3000 rmb/ton. Ferrovanadium 50# prices have risen by about 25000 rmb/ton and 80# prices increased by 20000 rmb/ton. Vanadium-nitrogen prices increase by about 20000 rmb/ton. With expectation of further price increase, the suppliers mostly are reluctant to give offers.

Steel mills’ bidding prices

| Company | Product | Price (RMB/TON) | QTY (TON) | Basis |

| Laiwu Steel | Vanadium-nitrogen | 399800 | 160 | Acceptance, tax inclusive |

| Kunming Steel | Vanadium-nitrogen | 398800 | 10 | Acceptance, tax inclusive |

| Henan Yuanji | Vanadium-nitrogen | 420000 | 10 | Acceptance, tax inclusive |

| JISCO | Vanadium-nitrogen | 410000 | 30 | Acceptance, tax inclusive |

China vanadium market review

China ammonium metavanadate market

Ammonium metavanadate production is reduced greatly due to one more time of environmental inspections. For example, Chuangda just produced 10 tons of ammonium metavanadate as they suspended production early June. The company plans to resume at the middle of July. Other small-scale factories are not sure about the resumption time. Ammonium metavanadate output is anticipated to increase in July and the prices may go further up amid continued supply tightness.

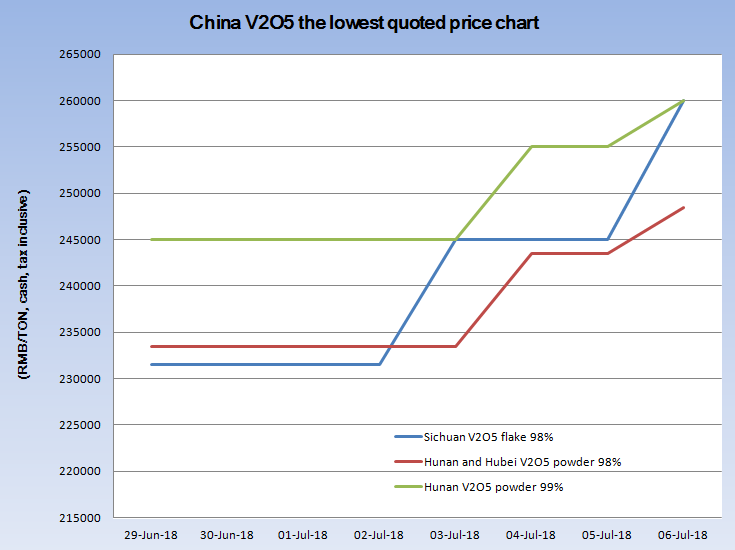

China vanadium pentoxide market

V2O5 flake transaction prices increase to 25000-270000 rmb/ton (acceptance, tax inclusive). Tranvic and Jianlong don’t give offers since they have no spot cargoes. The market inventories sit at lows, the number of enquiries declines, and the transaction volume continues to be low.