Vanadium Miners News For The Month Of September 2020

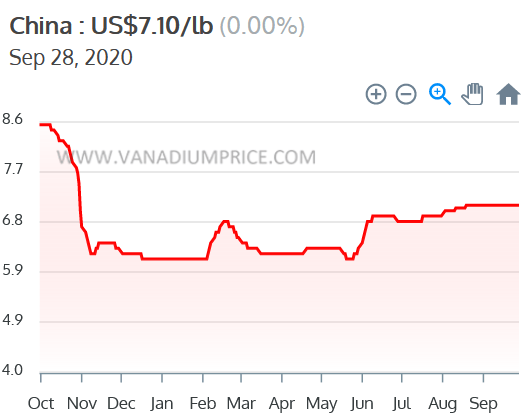

Vanadium spot prices were flat in September.

Vanadium market news – Battery metals to boom despite widespread Covid-19 disruption. Residential vanadium flow battery systems under development for Australia’s solar storage market.

Vanadium company news – Australian Vanadium and Technology Metals Australia get their Mining leases granted. Vanadium Resources releases a strong Scoping Study.

TNG Limited signs an off-take agreement and Australian Vanadium signs an offtake MOU. Silver Elephant subsidiary completes acquisition of Bisoni Vanadium Project.

I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Welcome to Vanadium miners news. September saw vanadium prices flat for the month. There was some very good news from the vanadium juniors including two Australian juniors granted their Mining Lease, a strong Scoping Study result, some vanadium juniors obtaining vanadium off-take agreements/MOUs, and a vanadium project acquisition.

Vanadium uses

Vanadium is traditionally used to harden steel. New Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

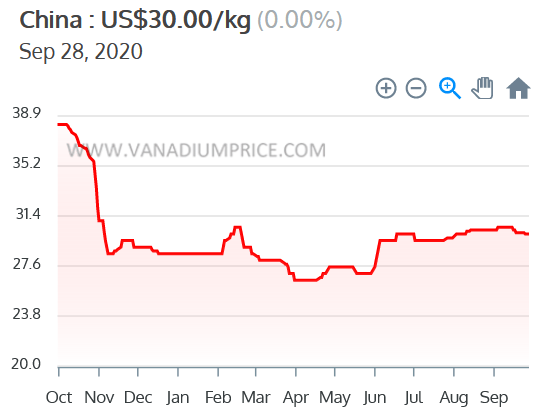

Vanadium spot price history

China Vanadium Pentoxide [V2O5] Flake 98% 1-year chart – Price = USD 7.10/lb

China Ferrovanadium [FeV] 80% Price = USD 30.00

Source: Vanadiumprice.com

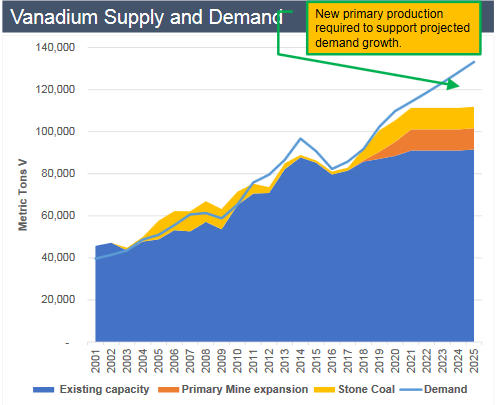

Vanadium demand versus supply

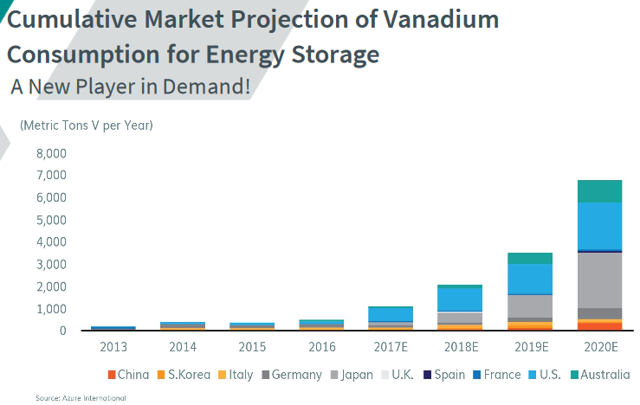

The charts below show energy storage to be a new source of vanadium demand, and overall demand looks likely to grow very strongly to 2025.

Vanadium total demand forecast to outstrip supply 2020-2025

Source: Technology Metals Australia investor presentation & TTP Squared

Roskill estimates that vanadium demand “for VRFB markets” could rise to 31,000 tons by 2025, amounting to a rise of 3,100% in a decade.

Source: Australian Vanadium presentation

In 2017, Robert Friedland stated:

We think there’s a revolution coming in vanadium redox flow batteries,” he says. “You’ll have to get into the mining business and produce ultra-pure vanadium electrolyte for those batteries on a massive scale. We’re very deeply interested in how you store electrical energy in the grid. The beauty of the vanadium redox battery is that you can charge and discharge it at the same time, something that can’t be done with a lithium battery. With a vanadium redox flow battery, you can put solar power and wind power into the battery, and you can put excess grid power into the battery at night, and at the same time you can have a stable output into the grid.

Vanadium market news

On September 2, Bushveld Minerals gave a vanadium market update stating:

Vanadium and VRFB Markets

- “Chinese demand increased in Q2 2020 supported by increased infrastructure spending in line with RMB3.75 trillion (approximately US$500 billion) investment plan to encourage infrastructure investment. This has resulted in price disparities between China and the rest of the world. Robust demand from China is expected for the rest of the year.

- The Group has taken advantage of the robust vanadium demand and higher price from China compared to other jurisdictions and increased its Chinese sales. As at the end of H1 2020, Bushveld Minerals supplied 18 percent of its sales to China, compared to three percent in H1 2019.

- Demand from the North American and European steel and aerospace industries declined during the period due to the pandemic and associated plant shutdowns. Demand from the United States and Europe is expected to remain constrained for the rest of the year due to the economic slowdown.

- The European Union agreed a €1.8 trillion (approximately US$2.1 trillion) budget and coronavirus recovery fund to confront the recession, which is expected to include significant infrastructure spend.

- The Covid-19 pandemic has increased the delivery period to customers due to logistics constraints at ports. The increase in transit time has affected overall sales volumes for Q2 2020 and is expected to continue for the rest of the year.

- Increased deployment of VRFBs and demand, is likely to rise as governments focus on accelerating the energy transition to a low-carbon energy future, which will increase vanadium demand.

- The London Metal Bulletin Ferrovanadium price averaged US$25.70/kgV in H1 2020, 54 percent lower than H1 2019 (H1 2019: US$56.30/kgV), four percent below H2 2019 (H2 2019: US$26.90/kgV).”

On September 11, Mining Weekly reported:

Battery metals to boom despite widespread Covid-19 disruption. Battery metals, including lithium, vanadium, copper, cobalt, nickel, lead and graphite, are increasingly used in larger-scale battery storage products and in components used to transmit and distribute electricity. In terms of EVs, the focus is on electric-only EV development and roll-out. The progression of the EV will also shift development away from the concept car and towards the mass production of EVs for daily use. “All these will be enormous drivers of the demand for lithium, cobalt, nickel and vanadium, but above all copper.”

The battery boom will lead to a battery metals boom

On September 16, Resource World reported: “The restart to Canada’s economy must “think big” and “be green.”

On September 17, Energy Storage news reported:

Residential vanadium flow battery systems under development for Australia’s solar-storage market. Energy storage systems based around vanadium redox flow batteries (VRFBs) are being developed for residential use in Australia by partners Australian Vanadium [AVL] and Gui Zhou Collect Energy Century Science and Technology.

On September 28, The Chinese Academy of Sciences Newsroom reported:

AI technology can predict Vanadium Flow Battery performance and cost. Novel methods to accurately predict the performance and cost of a VFB stack and further system are needed in order to accelerate the commercialization of VFBs. Recently, a research team led by Prof. LI Xianfeng from the Dalian Institute of Chemical Physics (DICP) of the Chinese Academy of Sciences proposed a machine learning-based strategy to predict and optimize the performance and cost of VFBs.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

No vanadium news for the month.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

No news for the month.

You can view the latest investor presentation here.

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On September 2, Bushveld Minerals announced: “Q2 2020 and H1 2020 operational update.” Highlights include:

Bushveld Vanadium

- “Group production for Q2 2020 of 778 mtV (100 percent basis) was five percent higher than Q2 2019 (Q2 2019: 742 mtV) through the inclusion of production from the recently acquired Vanchem processing assets.

- Group production for H1 2020 of 1,649 mtV (100 percent basis) was 18 percent higher than H1 2019 (H1 2019: 1,392 mtV), as a result of the inclusion of the production from the Vanchem processing assets for the full six month period.

- Estimated production losses of approximately 380 mtV were directly related to the Covid-19 nationwide lockdown in H1 2020. The production losses are comprised of 300mtV at Vametco and 80mtV at Vanchem…..”

On September 7, Bushveld Minerals announced:

Vanadium rental partnership with invinity…..This partnership puts the rental model into a specific business unit, formalising a commercial partnership and ring fencing the vanadium rental sub-entity. We anticipate adding other rental agreements and VRFB companies to the partnership in growing the electrolyte rental model, ensuring that the VRFB is affordable and the most sustainable battery technology.”

You can view the latest investor presentation here.

Largo Resources [TSX:LGO] [GR:LR81] (OTCQX:LGORF)

Largo Resources is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil.

No news for the month.

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio,” as well as being a recent vanadium producer.

No news for the month.

Ferro Alloy Resources [LON:FAR]

FAR is developing the giant Balasausqandiq vanadium deposit in Kyzylordinskaya Oblast of southern Kazakhstan. FAR state: “The ore at this site has a significantly higher grade than all other primary vanadium extraction sites, which allows for much lower processing costs.”

On September 2, Ferro Alloy Resources announced:

Development of process to make VFB electrolyte and issue of bonds…..the Company has developed technology for the production of electrolyte for vanadium flow batteries (“VFBs”). Ferro-Alloy has developed the technology and applied for a patent for the production of vanadium electrolyte directly from ammonium metavanadate (“AMV”).

Vanadium developers

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

No news for the month.

Investors can read the latest company presentation here.

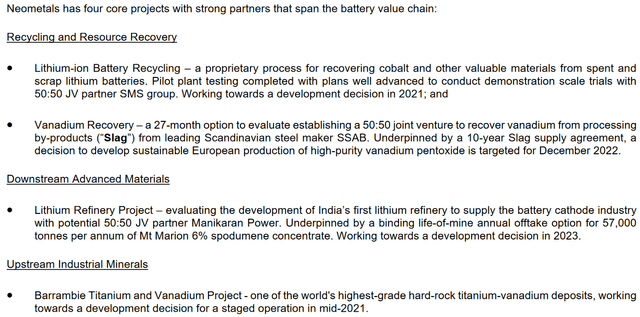

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100% own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On September 23, Neometals announced: “Annual financial report for the financial year ended 30 June 2020.” The screenshot below gives a nice summary update, including their vanadium projects.

You can view the latest investor presentation here.

Australian Vanadium [ASX:AVL] [GR:JT71] (OTC:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia.

On August 31, Australian Vanadium announced:

Mining lease granted for the Australian Vanadium Project. The granting of the Mining Lease is a major milestone in the Company’s pathway to development of the Project. The Project consists of 11 tenements covering 760 sq km and is held 100% by Australian Vanadium Limited. The granted Mining Lease M 51/878 covers approximately 70% of the declared Mineral Resources over a single continuous area, with the balance of the Inferred Mineral Resource located on the adjoining Mining Lease application MLA 51/890, owned 100% by AVL.

On September 9, Australian Vanadium announced: “MOU for vanadium offtake, electrolyte supply and battery sales agency.” Highlights include:

- “AVL signs Memorandum of Understanding with CellCube vanadium redox flow battery [VRFB] manufacturer Enerox GmbH.

- VSUN Energy signs Value Added Reseller Agreement with Enerox GmbH.

- Extensive Memorandum of Understanding includes development of: Vanadium pentoxide offtake arrangements to support global VRFB sales by Enerox. A vanadium electrolyte facility in Australia to supply Enerox battery installations. Assistance with arrangement of vanadium electrolyte leasing.

- Enerox GmbH is a global market leader of VRFBs based in Austria, with over 100 installations worldwide.”

On September 16, Australian Vanadium announced: “Residential vanadium redox flow battery development and vanadium offtake MOU.” Highlights include:

- “Memorandum of Understanding [MOU] signed with Chinese vanadium redox flow battery [VRFB] manufacturer Gui Zhou Collect Energy Century Science and Technology Co Ltd, trading as CEC VRFB Co. Ltd [CEC], based in Guizhou province.

- MOU provides a framework for one or more binding agreements.

- Offtake agreement for vanadium pentoxide supply for CEC VRFBs installed in Australia and internationally.

- Electrolyte production within Australia for use in CEC VRFBs;

- Product development of CEC’s residential VRFB for the Australian market.

- 12-month exclusivity over sales of CEC’s residential VRFBs in Australia.

- Australia’s first grid-connect ready 5kW/30kWh residential VRFB ordered from CEC, due to be delivered to the Port of Fremantle in late October 2020.”

Catalysts include:

- Early 2020 – Possible further off-take and/or JV partner announcements.

- 2020 – DFS due.

You can view the latest investor presentation here, or read “Australian Vanadium Managing Director Vincent Algar Talks With Matt Bohlsen Of Trend Investing.”

Technology Metals Australia [ASX:TMT]

The Company’s primary exploration focus is on the 100% owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia.

On September 1, Technology Metals Australia announced: “Gabanintha vanadium project mining leases granted.”

On September 16, Technology Metals Australia announced: “32% increase to GVP ore reserve delivers 22.5 year life of mine.” Highlights include:

- “Gabanintha Vanadium Project Proven and Probable Ore Reserve estimate increased to 39Mt at 0.9% V2O5–a 32% increase on the DFS Ore Reserve.

- Maiden Southern Tenement Probable Ore Reserve estimate of 9.4Mt at 0.97% V2O5–a very high 98% conversion from the Indicated Mineral Resource estimate.

- Life of mine operating schedule extended to 22.5 years based on production rate of 13,000T pa V2O5.

- Global Mineral Resource estimate of 137.2Mt at 0.9% V2O5 provides clear scope for future mine life extensions.

- DCF analysis conducted by CSA Global concluded that the Southern Tenement provided a positive economic impact to the GVP.”

Catalysts include:

- 2020 – Possible further off-take announcements. Possible funding or equity partner announcements.

You can view the latest investor presentation here, or read “Technology Metals Australia Execetive Director Ian Prentice Talks With Matt Bohlsen Of Trend Investing.”

TNG Ltd. [ASX:TNG] [GR:HJI] (TNGZF)

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd. is well-advanced with a massive $4.7b NPV8%, but relies on titanium and iron with a lower grade vanadium by-product.

On September 16, TNG Ltd. announced:

Vanadium offtake agreement. Australian resource and mineral processing technology company TNG Limited provides an update on the negotiations for a life-of-mine Offtake and Marketing Agreement (“Agreement”) with global commodity trader, Gunvor (Singapore), for 40% of the vanadium pentoxide that is intended to be produced by the Company’s flagship 100%-owned Mount Peake Vanadium-Titanium-Iron Project in the Northern Territory, Australia.

You can view the latest investor video presentations here.

Aura Energy [ASX:AEE] [GR:VU1] (OTC:AUEEF)

Aura Energy is an Australian-based minerals company that 100% owns polymetallic and uranium projects with large resources in Sweden (Häggån Project) and Mauritania (Tiris project). Aura’s focus is on the Häggån Project, located in Sweden’s Alum Shale Province, one of the largest depositories of vanadium in the world.

No news for the month.

You can view the latest investor presentation here.

Silver Elephant Mining Corp. [TSX:ELEF] (OTCQX:SILEF) (Formerly Prophecy Development Corp. TSX:PCY (PRPCF))

Silver Elephant Mining Corp. is a Canadian public company listed on the Toronto Stock Exchange. The Company’s objective is to advance the Gibellini Black Shale primary vanadium project in the Battle Mountain region in northeastern Nevada to production. Gibellini aims to be the first active primary vanadium mine in North America. They also have huge silver assets in Bolivia.

On September 18, Silver Elephant Mining Corp. announced:

Silver Elephant subsidiary completes acquisition of Bisoni Vanadium Project. Silver Elephant Mining Corp. announces that its wholly-owned subsidiary Nevada Vanadium LLC (“Nevada Vanadium”) has completed the acquisition of the Bisoni vanadium project (“Bisoni Project”) from CellCube Energy Storage Systems Inc. (“Cellcube”) pursuant to the Asset Purchase Agreement (“APA”) announced on August 24, 2020. The Bisoni Project is situated immediately southwest to Nevada Vanadium’s Gibellini Project. Under the terms of the APA, the Company has issued 4 million Silver Elephant common shares (“Compensation Shares”) and paid $200,000 cash to Cellcube. The Compensation Shares are subject to a statutory four-month and one day hold period expiring on January 19, 2021.

You can view the latest investor presentation here.

Vanadium Resources Limited [ASX:VR8] (formerly Tando Resources [ASX:TNO])

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74% of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

On August 27, Vanadium Resources Limited announced:

Funding secured to advance company…..”A$500,000 of funding secured from Directors and Shareholders through an unsecured non-recourse loan facility……

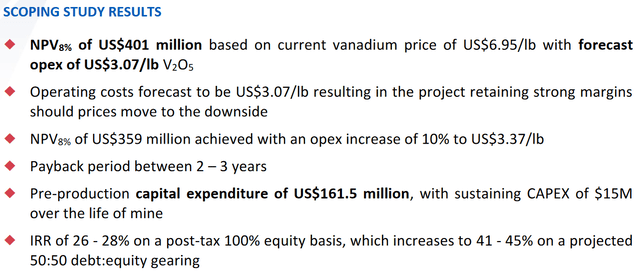

On September 3, Vanadium Resources Limited announced: “Scoping Study results confirm viability of vanadium pentoxide production at Steelpoortdrift at current prices.” Highlights include:

- “Scoping Study exhibits globally competitive opex and capex metrics and confirms that production of vanadium pentoxide utilising conventional salt roast-leach processing methods is technically and financially viable…..

- VR8 to embark on pre-feasibility study [PFS] immediately as well as focus on attracting strategic partnerships.”

Scoping Study summary

On September 28, Vanadium Resources Limited announced: “Annual report for the year ended 30 June 2020.”

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However, their deposits also contain vanadium.

On September 7, King River Resources announced:

Speewah PFS update. King River Resources Limited is progressing the Speewah Prefeasibility Study (“PFS”) on the company’s 100% owned Speewah Specialty Metals (“SSM”) Project in the East Kimberley of Western Australia. The KRR PFS has assumed a Kimberley focus that would produce High Purity Alumina [HPA], with future potential co-products Vanadium [V2O5], Titanium [TiO2] and Iron (Fe oxide) not being included as part of this initial study.

You can view the latest investor presentation here.

VanadiumCorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:APAFF)

VanadiumCorp Resources Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

No news for the month.

You can view the latest investor presentation here.

First Vanadium Corp. [TSXV:FVAN] (FVANF) (OTCQB:CCCCF) (formerly Cornerstone Metals Inc.)

Cornerstone’s Carlin Vanadium project hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a historic Inferred Resource 28Mt at 0.525% V2O5 (2010 SRK).

No news for the month.

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTC:OTCPK:SYAAF) (OTC:SRHYY)

- Triton Minerals [ASX:TON] [GR:1TG]

- Battery Minerals [ASX:BAT]

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTCPK:DMNKF)

Other listed vanadium juniors

- Golden Deeps [ASX:GED]

- Sabre Resources [ASX:SBR]

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Venus Metals [ASX:VMC]

- Intermin Resources [ASX:IRC]

- Vanadium One Energy Corp. [TSXV:VONE] [GR:9VR1] (OTC:VDMRF)

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Maxtech Ventures [CSE:MVT]

- Pursuit Minerals [ASX:PUR]

- Victory Metals [TSXV:VMX]

- BlackRock Metals (Private)

- Gladiator Resources [ASX:GLA]

- Sabre Resources [ASX:SBR]

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Cellcube Energy Storage [TSXV:CUBE] (STNUF)

Conclusion

Vanadium spot prices were flat in September.

Highlights for the month include:

- Bushveld Minerals forecast: “Robust demand from China is expected for the rest of the year.”

- Battery metals to boom despite widespread Covid-19 disruption.

- Residential vanadium flow battery systems under development for Australia’s solar-storage market.

- New AI technology can predict Vanadium Flow Battery performance and cost.

- Bushveld Minerals (Vanadium group) – Group production for H1 2020 of 1,649 mtV (100 per cent basis) was 18 percent higher than H1 2019 (H1 2019: 1,392 mtV).

- Australian Vanadium – Mining lease granted and residential vanadium redox flow battery development and vanadium offtake MOU signed with Chinese vanadium redox flow battery [VRFB] manufacturer Gui Zhou Collect Energy Century Science and Technology Co. Ltd.

- Technology Metals Australia Gabanintha Vanadium Project mining leases granted and 32% increase to GVP ore reserve delivers 22.5-year life of mine.

- Vanadium Resources Limited Steelpoortdrift Scoping Study results – NPV8% of US$401 million based on current vanadium price of US$6.95/lb with forecast opex of US$3.07/lbV2O5. Pre-production capital expenditure of US$161.5 million.

- TNG Limited signs a Vanadium offtake agreement with Gunvor (Singapore), for 40% of the vanadium pentoxide that is intended to be produced by the Company’s flagship 100%-owned Mount Peake Vanadium-Titanium-Iron Project.

As usual, all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors with a focus on renewable energy & the EV and EV metals sector. You can learn more by reading “The Trend Investing Difference,” “Subscriber Feedback On Trend Investing,” or sign up here.

Latest articles:

- Who Will Win The Lucrative Autonomous Vehicles (Robotaxis) Race?

- Silver Elephant Mining Is Growing A Massive Silver Resource In Bolivia

Disclosure: I am/we are long GLENCORE [LSX:GLEN], AMG ADVANCED METALLURGICAL GROUP NV [AMS:AMG], LARGO RESOURCES [TSX:LGO], NEOMETALS [ASX:NMT], AUSTRALIAN VANADIUM [ASX:AVL], SYRAH RESOURCES [ASX:SYR], TRITON MINERALS [ASX:TON], SILVER ELEPHANT MINING CORP. [TSX:ELEF]. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

www.seekingalpha.com