Thank you for subscribing to receive Prophecy (TSX: PCY, OTCQX: PRPCF)

latest news and alerts.

Here is the link to Critical Metal Report from the Department of Commerce.

You can check latest vanadium price at www.vanadiumprice.com.

Date: June 12, 2019

By: www.vanadiumprice.com

Must Watch: Prophecy’s Executive Chairman John Lee, CFA talks about Rare Earth and Vanadium

As reported by Reuters "China rare earth prices soar on their potential role in trade war", Chinese rare earth prices are set to climb beyond multi-year highs following a flurry of state media reports that Beijing could weaponize its supply-dominance of the prized minerals in its trade war with Washington. Rare earth metals, a group of 17 elements that appear in low concentrations in the ground, are used in a wide-range of products stretching from lasers and military equipment to magnets found in consumer electronics.

China supplied 80% of the rare earth metals imported by the United States from 2014 to 2017. Chinese state newspapers last month reported that Beijing could use that fact as leverage in the ongoing trade dispute between the two countries.

Rare Earth Mining Stocks have soared in response to the news, with prices shooting up 200%, 300%, and more in the past two weeks.

Ucore Rare Metals Inc. Share Price

Avalon Advanced Material Inc. Share Price

Vanadium may be the next trade target and big spike

Bank of Montreal has recently come out with a bullish vanadium research report.

Highlights:

Discover the only vanadium mine that matters

With US importing 100% of its vanadium, Gibellini is the only vanadium mine that matters for North American investors.

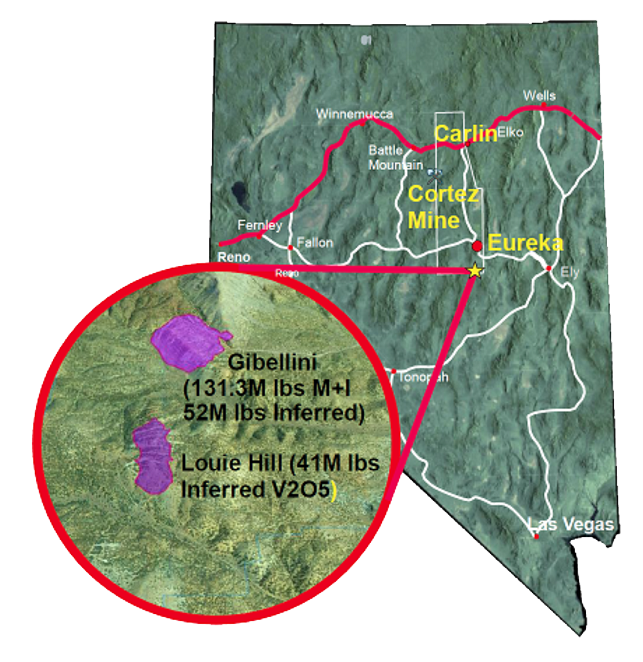

The Gibellini vanadium deposit, developed by Prophecy Development Corp (TSX: PCY, OTCQX: PRPCF) and located in the heart of the Nevada mining district, is the only mine that could bring about vanadium production in the USA in the near term. Its construction is planned for 2021, with production expected in 2022.

President Trump signed an executive order titled “Improve Access to Domestic Critical Mineral Resources on Federal Lands and Reduce Federal Permitting Timeframes.”

Gibellini’s forecast vanadium production would constitute 3% of the world’s supply. That would satisfy half of US demand.

Only by investing in US vanadium mines will you be able to gain maximum benefit from rising vanadium prices and the Buy America policy.

Don’t be left behind by buying vanadium mines in China, Russia, and South Africa, where your profit margin can be eaten up by tariffs and import barriers.

Find out more about Gibellini’s project development plan put forward by this "Secret Vanadium Company".

Must Watch: Prophecy’s Executive Chairman John Lee, CFA talks about coming squeeze in vanadium

Here comes the trigger for vanadium - Stay ahead of the herd

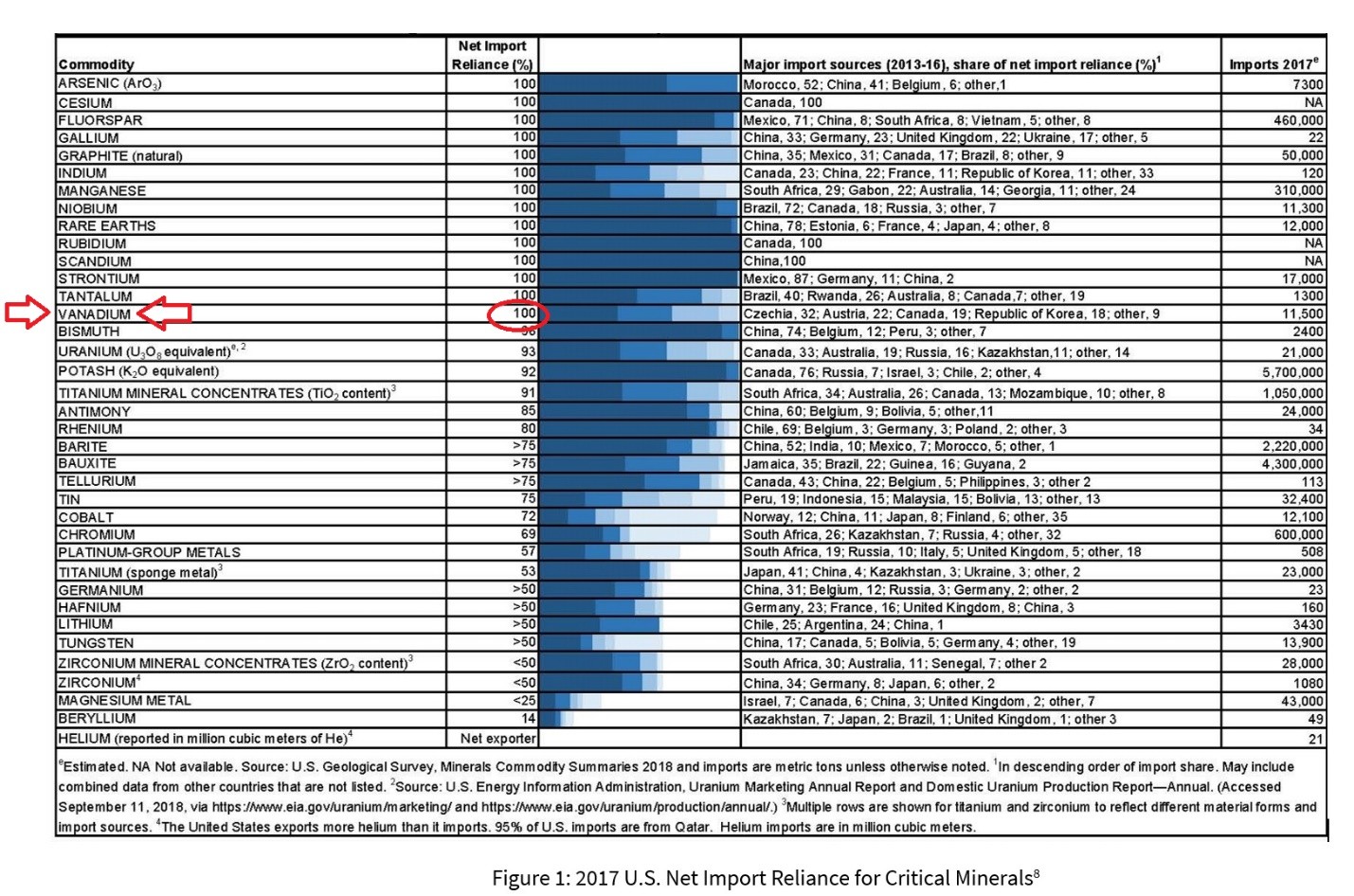

On June 4, 2019, the US Department of Commerce (DoC) issued a press release on critical metals. Vanadium and rare earth metals are mentioned among 35 critical metals.

The report shows United States has 100% import reliance on vanadium and rare earth metals.

DoC simultaneously published a 50-page report, “Federal Strategy to Secure Supplies of Critical Metals,” a strategy which may include creating a national strategic stockpile that could cause vanadium prices to sky rocket.

The Buy American policy puts US vanadium mines in hot demand

In April 2019, the US Department of Commerce introduced the results of an investigation under Section 232 of the Trade Expansion Act of 1962. They propose a quota that in effect reserves 25 percent of the domestic market for US-mined uranium and establishes a "Buy American" policy for U.S. government entities that use uranium.

Experts believe Section 232 can be applied to vanadium. That could double or more US vanadium prices.

The Mining Rush is on in Nevada Again

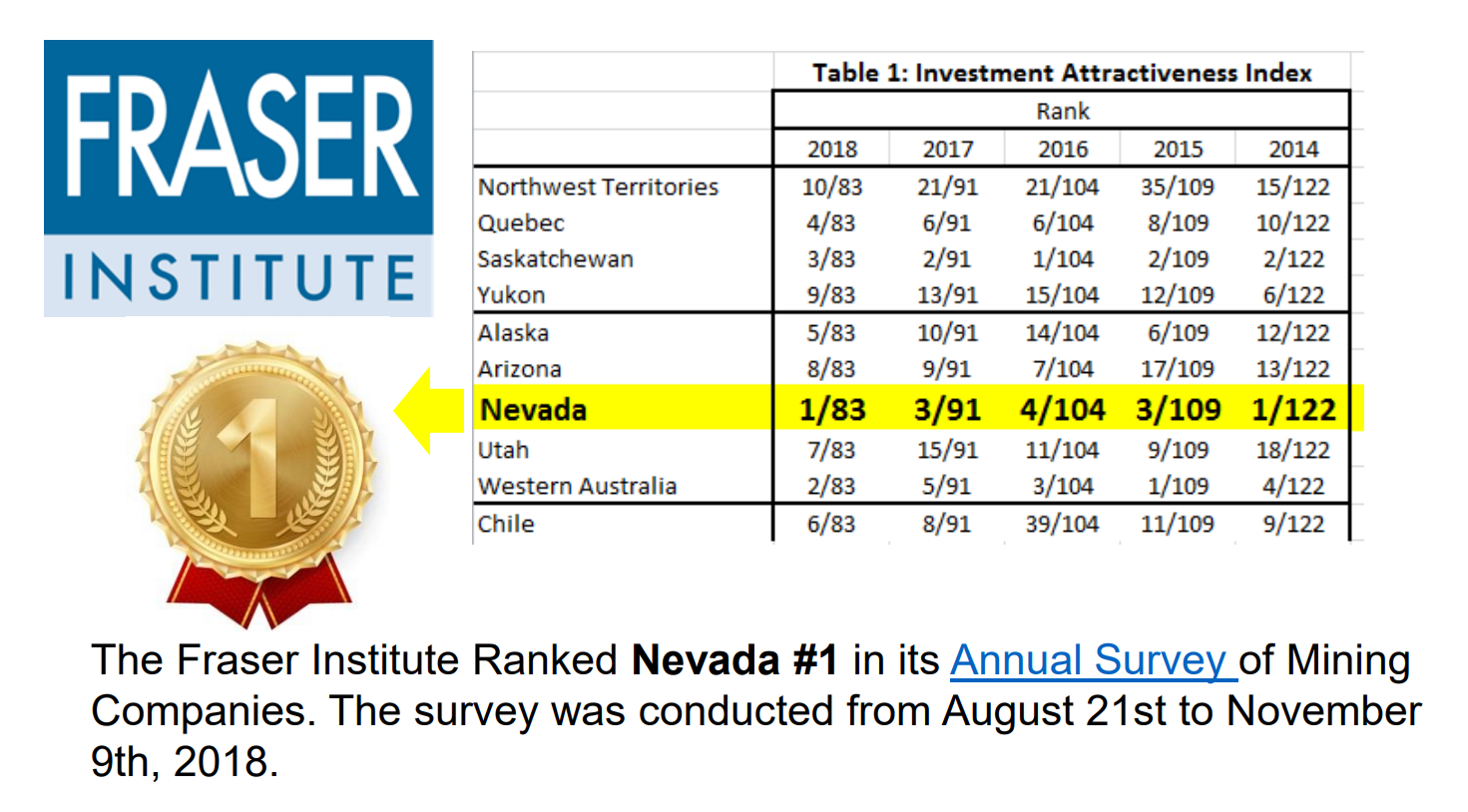

The renowned Canadian think tank Fraser Institute ranked Nevada as the world’s #1 jurisdiction for mining investment.

Prophecy’s Gibellini vanadium project in Nevada is ideally located in the midst of all the major gold and silver mines operated by mining giants Barrick and Newmont.

Due to its great location and exceptional project economics, Gibellini is the prime acquisition target for major US mining companies.

Learn more about Gibellini project economics.

Exceptional mine operating margin, strong forecast cashflow, and a mine managed by its builders.

Gibellini vanadium project features low-cost open-pit mining and industry-proven heap-leach recovery methods whereby over 90% of Nevada metal production is processed through heap leaching.

Gibelliini is being managed by Prophecy (TSX: PCY, OTCQX: PRPCF). The mine builders are from Barrick, Klondex, and McEwen Mining.

In our recent interview with him, Prophecy CEO Mike Doolin (who joined Prophecy in 2019) is quoted as saying he is confident of repeating at Prophecy the success he had with Klondex.

Klondex Mines Ltd. Share Price

Klondex was a five-bagger prior being acquired by Hecla for $462 million in 2018.

Find out more about Prophecy’s proven management team.

Buy low, Sell High

Bank of Montreal, a major Canadian investment bank, arranged for Prophecy (TSX: PCY, OTCQX: PRPCF) a $5.5 million bought deal financing at 46 cents just six months ago.

Many independent mining analysts, such as Nick Hodge of the Outside Club and Louis James of Independent Speculators, have visited Gibellini and published their interviews and research on Prophecy and Gibellini.

“Great, fantastic topographical advantages” commented Mr. James on his Gibellini trip in June 2019.

With the recent correction in metals market, Prophecy (TSX: PCY, OTCQX: PRPCF) can now be had for half of what BMO paid. Don’t let this opportunity slip by.

Snap up Prophecy (TSX: PCY, OTCQX: PRPCF) before someone else does at a bargain 17 cents.

By providing your email you are giving your consent to receive communication from Prophecy Development Corp.

Watch Vanadium – breathtaking new age metal, and Introducing Gibellini project.

Trade Prophecy at links below:

US Brokers (OTC: PRPCF)

www.tdameritrade.com

www.etrade.com

www.fidelity.com

www.merrilledge.com

Canadian Brokers (TSX: PCY)

www.Td.com

www.rbcdirectinvesting.com

www.qtrade.com

www.questrade.com

www.scotiabank.com/itrade

www.bmo.com/investorline

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained on this webpage (including statements which contain the words “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates”, and similar expressions) and statements related to matters which are not historical facts constitute “forward-looking” information within the meaning of applicable securities laws. Such forward-looking statements, which express management’s expectations regarding Prophecy’s future growth, results of operations, performance, business prospects, and opportunities, are based on certain factors and assumptions. They involve known and unknown risks and uncertainties that may cause the actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by such forward-looking statements.