Hardey pens agreement to acquire established vanadium mine

Date: Jul 04, 2018

Hardey Resources Limited (ASX:HDY) has entered into an agreement aimed at facilitating the acquisition of a company that owns a vanadium mine that has produced high-grade ore in the past.

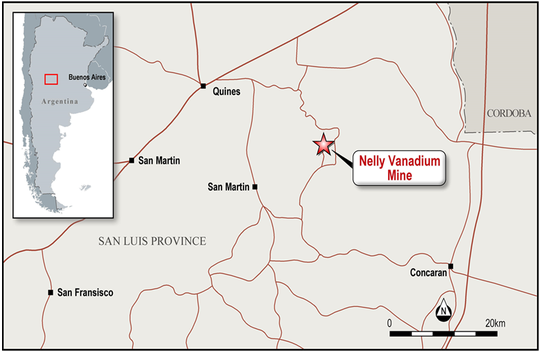

The company has entered into a share sale agreement with the shareholders of Nelly Vanadium Pty Ltd (NVPL), owners of the Nelly Vanadium Mine in San Luis Province in Argentina.

Under the terms of this agreement, Hardey has been granted a 40-day option to acquire 100% of the issued capital of NVPL.

Hardey Resources’ non-executive director, Terrence Clee highlighted the compelling near term outlook for the Nelly Vanadium Mine in saying, “Upon finalising the acquisition, the Board’s focus will be on undertaking exploration activities with the aim of proving up a JORC compliant resource and moving to re-open the Nelly Vanadium Mine.”

There is still a lot of work to do here, so investors should seek professional financial advice for further information before making an investment decision.

Nelly offers attractive metrics

The Nelly Vanadium Mine comprises several vanadium-rich polymetallic sheeted vein systems, aligned north-east to south-west, that are approximately one kilometre long and up to 5.5 metres wide.

Of significance in determining the potential scope for resource extension, when Nelly was operating between 1949-57 only one vein was partially exploited, leaving most of the deposit intact.

Of significance in determining the potential scope for resource extension, when Nelly was operating between 1949-57 only one vein was partially exploited, leaving most of the deposit intact.

Past sampling and assay results throughout the historical workings produced grades from the partially mined vein that ranged up to 1.9% vanadium with a length weighted sample average of 0.82 per cent vanadium.

NVM has access to reliable power and water, while there is a transport infrastructure connecting the mine to key ports.

High grades will improve economic viability

The Nelly mine is on a 53-hectare tenement 170 kilometres from the capital of San Luis Province in Argentina.

The mine has ready access to mains power and water supplies, while nearby towns can provide supporting services and skilled labour.

Transportation infrastructure from the mine to key ports will allow the company to access major end markets.

In terms of output, a processing plant on-site produced nearly 4000 kilograms of vanadium and 400 kilograms of VO3NH4, an important intermediate in the purification of vanadium.

Modern technology should see an uptick in production

This level of production is fairly moderate by today’s standards, as at that time concentration processes were at an experimental stage, preventing the attainment of critical scale.

The primary customers during the 1950s in Argentina were national alloy and acid manufacturers.

During the 1950s, Nelly Vanadium was one of the few operating mines that had an on-site processing plant and accommodation for employees, arguably reflecting the significance of the deposit.

Exploration upside

The mine was initially developed as an open pit, and subsequently underground galleries were progressed, but there is extensive scope for exploration of existing veins at depth.

Studies undertaken and samples extracted most recently in 1974 have indicated that there is the presence of other base and precious metals.

In 2017, assay results on samples taken from the open pit and tailings confirmed high-grade mineralisation with up to 1.6 per cent vanadium oxide, confirming the high grades historically mined.

When Nelly Vanadium was operating during the 1950s, only part of the known resource was exploited, leaving most of the untapped mineralisation intact.

The extent of the resource will be a key focus in coming months, quite possibly offering considerable exploration upside.

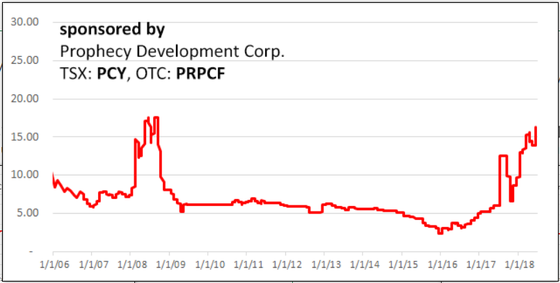

The economic viability of developing vanadium projects has improved substantially as a result of a strong rally in the commodity price.

Vanadium’s supply demand metrics appear robust

Hardey is optimistic that demand for vanadium will remain robust over the next few years, as structural changes augur favourably for the continued expansion of the renewable battery sector.

Indeed, the vanadium price is looking strong, as indicated above, trading in the vicinity of US$16.30 per pound.

Indeed, the vanadium price is looking strong, as indicated above, trading in the vicinity of US$16.30 per pound.

This is pushing up towards levels not seen since 2008/09.